Attention Pinnacle CU Members | Account Conversion Reminders!

The system conversion to transition your Pinnacle CU accounts to Peach State FCU accounts is October 31st-November 2nd. Here are some important reminders to ensure a smooth transition:

- Pinnacle’s Bill Pay service will become inactive on 10.30.25. As a result, you will need to stop all Bill Pay payments scheduled for 10/30 or later because they will not be processed. You can enroll in Peach State’s Bill Pay service after November 2nd.

- The Ben Mays, Glenwood, and Putman branches will be closing at 2 p.m. on October 31st in preparation for the system conversion.

- You may continue to use your Pinnacle Mastercard Debit Card through November 6th at 3 a.m. or until your Peach State Debit Card is activated, whichever comes first. During conversion weekend, there may be times when your Debit Card transactions cannot be processed due to temporary limits or connectivity. Prior to the conversion, please make plans to obtain the cash you’ll need during this time.

- Be sure to refer to the conversion guide for important information and next steps.

Welcome to the Peach State Family!

This merger joins together two long-standing organizations with a shared history of serving educators and a commitment to putting people first.

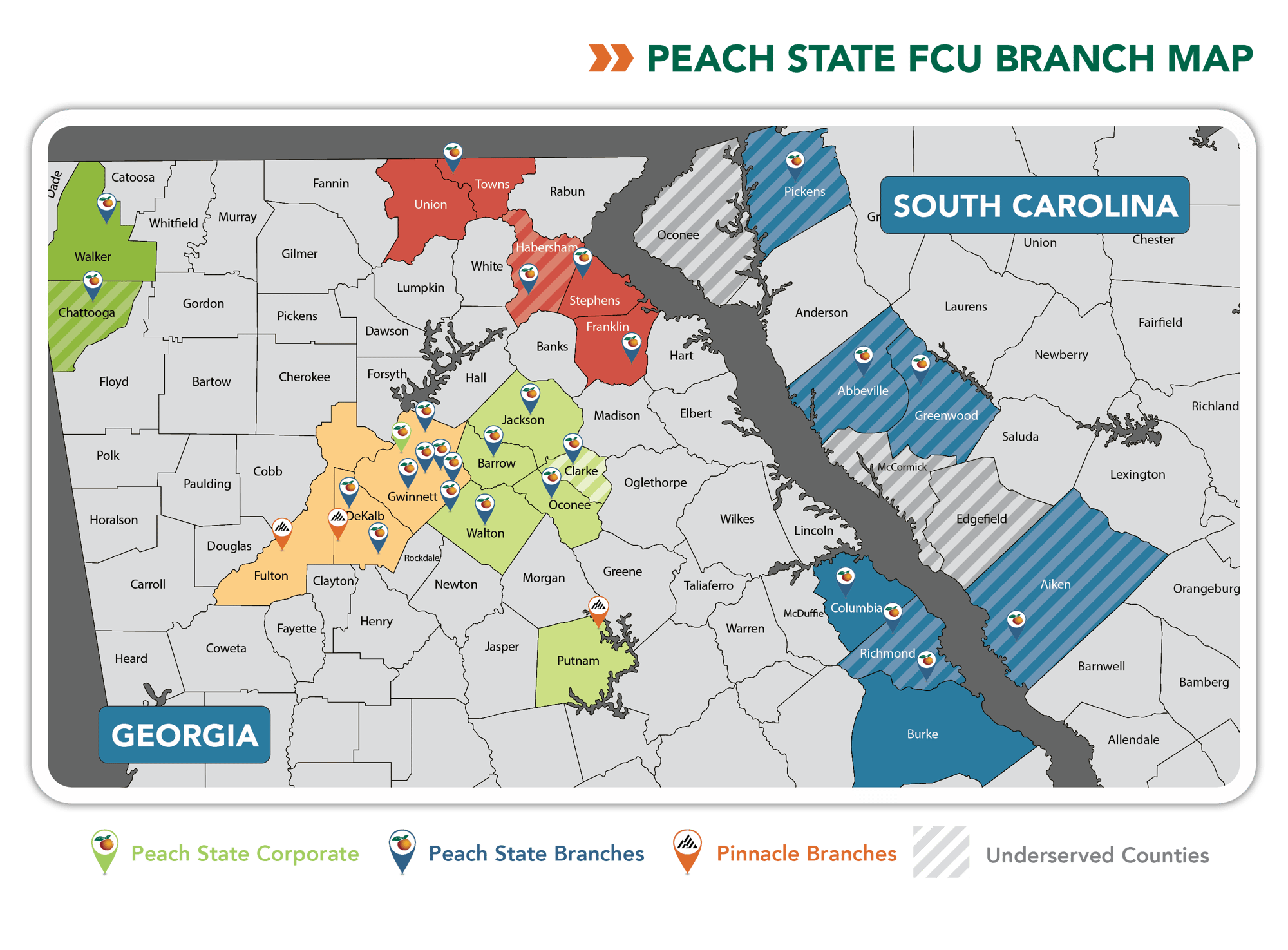

It is our goal to make this transition as smooth as possible for you. Once we get closer to the system conversion, we will be sure to share those details. Until then, please continue to use Pinnacle CU branches for all your banking needs. Once the conversion is complete, you will have access to all of Peach State products and services, as well as our branch locations throughout Georgia and South Carolina.

Rest assured that you will continue to receive the same level of service and care from the familiar faces you see today at the Ben Mays, Glenwood, and Putnam branches. As we progress through the merger, please check this page often for updates.

Marshall Boutwell

President/CEO

Peach State Federal Credit Union

What to Expect

Helpful Resources and Information

- Welcome Letter: Official welcome letters sent to all Pinnacle members mid-August.

- Conversion Notification Letter: Mailed to all Pinnacle members on July 18th; provides important information about the system conversion, which is taking place October 31st-November 2nd, and includes fees and charges that take effect November 1st.

- Conversion Guide: Mailed to all Pinnacle members on September 19th. Please be sure to review this prior to the conversion. It contains helpful information including important dates, next steps, Online and Mobile Banking set up instructions, and details about our products and services.

- New Peach State Account Letters: All Pinnacle members were sent a letter with information about their new Peach State Accounts.

- New Peach State FCU Visa Debit Cards: A few weeks prior to the conversion, Pinnacle Mastercard Debit Cardholders will receive new Peach State FCU Visa Debit Cards – the card that CARES. Every time you use your Peach State Visa Debit Card, we'll donate a nickel to the Peach State FCU C.A.R.E.S. Foundation, which supports non-profits, school systems, and the arts in the communities we serve.1

Important Dates

- September 19th: Conversion guides mailed to all Pinnacle members.

- October 30th: Pinnacle’s Bill Pay service will become inactive. As a result, you will need to stop all Bill Pay payments scheduled for 10/30 or later because they will not be processed. You can enroll in Peach State’s Bill Pay service after November 2nd.

- October 31st: Ben Mays, Glenwood, and Putnam branches will close at 2 p.m. in preparation for the conversion.

- October 31st-November 2nd: System conversion takes place.

- November 3rd: We anticipate the Ben Mays, Glenwood, and Putnam branches will re-open for business at 9 a.m.

1 $0.05 per transaction of Peach State Federal Credit Union’s merchant interchange income from our Visa Debit Card program is used to benefit the communities we serve. We will determine where/how funds are disbursed. This does not affect members’ accounts, nor will any member information be disclosed. You will not incur any additional fees or charges from this program. Merchant interchange income is derived from fees that a merchant pays to accept credit/debit card payments. The C.A.R.E.S. program may or may not apply to ATM transactions, certain commercial transactions, or other transactions not processed by Visa.

Branch Locations

Convenience in Your Communities

Beginning on September 1st you will be able to use Peach State ATMs. Prior to the conversion, you may use CO-OP Shared Branching offered at select Peach State locations to deposit and withdraw funds from your Pinnacle accounts.

Frequently Asked Questions

Why are Pinnacle CU and Peach State FCU Merging?

One of the most important reasons Peach State was selected as our merger partner is due to our shared history of serving educators. Peach State was founded in 1961 as Gwinnett Teachers Credit Union and currently serves 70,000+ members throughout Georgia and South Carolina. The merger will also provide members with competitive loan and deposit rates, as well as ensure greater community support.

What does the merger mean for members?

The merger between Pinnacle and Peach State will provide the opportunity to achieve more positive member impact and value.

- Expanded Member Access: Post conversion, members will have access to 26 additional branch locations and ATMs, and continued access to CO-OP Shared Branching at select locations.

- Enhanced Product and Service Offerings: This merger will enable us to offer more competitive loan and deposit rates.

- More Responsive to Growing Financial Needs: By merging, we’re ensuring that we can continue to meet the financial needs of our members in a highly competitive financial services industry.

- Same Knowledgeable and Friendly Staff: Our staff will become part of the Peach State team and enjoy enhanced employee benefits.

When will the merger take place?

The financial merger is effective September 1, 2024. The system conversion will take place October 31-November 2, 2025. More information will be shared with members well in advance of the conversion.

Can I use Peach State branches now?

Until the system conversion is complete, members will continue to use Pinnacle branches. You’ll be able to use Peach State branches that offer CO-OP Shared Branching for deposits and withdrawals.

Can I continue to use Pinnacle’s ATMs?

Yes. Members will also be able to use any of Peach State’s ATMs without a fee beginning September 1st.

Will any branches be closing?

There are currently no plans to close any branch locations.

How will my accounts be impacted?

For now, you will not have to do anything, and your accounts will remain with Pinnacle. Your account numbers may change as a result of the merger. More information will be sent to members at the end of September 2025.

Will my rates change?

The rates on fixed-rate loans and certificates will remain the same until the end of their existing terms. Other products will adjust as normal due to market conditions.

Will my direct deposit and payroll deductions stay the same?

Yes. If you currently have direct deposit to your account for your paycheck, pension, or social security, it will remain the same. This is also true for any payroll deduction. We will communicate any changes with you prior to the system conversion.

Will I need to get new checks, debit and/or credit cards?

You may continue to use your current checks, debit, and credit cards. We will communicate any changes with you prior to the system conversion.

Will my accounts continue to be federally insured?

Yes, your savings will continue to be federally insured by the National Credit Union Administration, a U.S. Government Agency, up to at least $250,000. Peach State also provides members with additional deposit insurance. Members’ accounts will be insured up to an additional $750,000 with coverage by Excess Share Insurance Corporation (ESI), a licensed insurance company, for a combined coverage of up to $1,000,000.

Will the Pinnacle name change to Peach State?

The financial merger between Pinnacle and Peach State is effective September 1, 2024. However, you won’t see Pinnacle’s name officially change to Peach State FCU on things like signage, member’s checks, credit cards, etc. until the system conversion is complete sometime in 2025. We will communicate this to members, including details on how this impacts your accounts, closer to that date.

If I have both Pinnacle and Peach State accounts, will they be combined after the conversion?

No, if you currently have dual membership with Pinnacle and Peach State, your accounts will not be combined upon conversion. You will have separate Peach State account numbers following the conversion. If you wish to combine these accounts into one account, please visit a Peach State branch after November 1st or contact us at 855.889.4328.

Questions About the Merger?

Please complete the form with your question(s) and a member of our team will be in contact with you.