Student and Teen Checking Account

- Ages 14-21 Those under age 18 must have a parent or guardian as a joint owner.

- Easily Transfer Money Access and move money when you need to.

- No Min. Balance There are no minimum balance requirements for eXtreme Checking.

- Balance Alerts Ability to set up low balance alerts through Online and Mobile Banking makes it easy to watch your spending.

SUCCESSFUL FUTURE

The Perfect Teen Checking Account for Their Future!

Managing a teen bank account correctly is a great way to gauge whether or not a teen is financially responsible enough for their first credit card or their first auto loan. Our eXtreme Checking even offers additional perks:

- FREE first order of 40 checks.

- FREE gift at account opening.

- FREE financial education from Balance Financial Fitness.

You Make A BIG Difference With Every

Purchase with the Card that C.A.R.E.S.!

You make an eXtreme impact when you bank with Peach State! Each purchase you make with your Peach State Visa Debit Card results in Peach State donating a nickel to the Peach State FCU C.A.R.E.S. Foundation, which supports non-profits, school systems, and the arts in the communities.1

With no additional effort or work, you get to help the people in your community. That's another reason why Peach State is a smart place for teens to bank!

1 $0.05 per transaction of Peach State Federal Credit Union’s merchant interchange income from our Visa Debit Card program is used to benefit the communities we serve. We will determine where/how funds are disbursed. This does not affect members’ accounts, nor will any member information be disclosed. You will not incur any additional fees or charges from this program. Merchant interchange income is derived from fees that a merchant pays to accept credit/debit card payments. The C.A.R.E.S. program may or may not apply to ATM transactions, certain commercial transactions, or other transactions not processed by Visa.

Can you get a Checking Account at 14?

Yes, at Peach State, our Student and Teen Checking Account is for ages 14-21. Set your teen up for success by encouraging responsible money management.

Those under 18 must have a parent or guardian as a joint owner. Use our Teen Checking Account to help gauge your teen's financial knowledge and empower them to learn healthy habits!

Testimonial

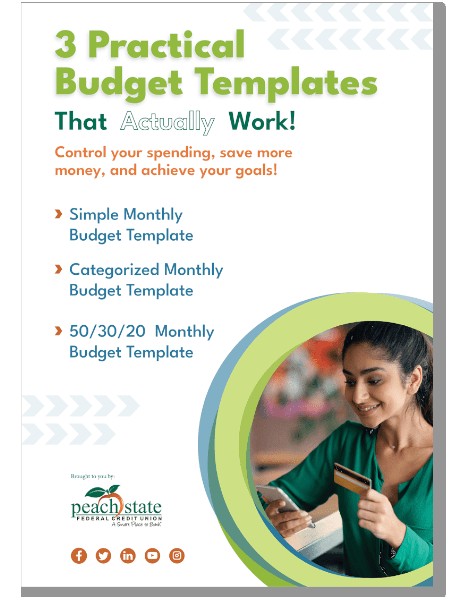

3 Free Templates!

Budgeting Templates

Stay in control of your finances! These budgeting templates make it easy to stay on top of your monthly spending and create good habits.

- Fillable online

- Calculates in real-time

- Easy to use and understand

Frequently Asked Questions

Peach State makes it easy to order a new debit card. You can either give us a call or visit any Peach State branch location. If you think you may be a victim of fraud, contact us immediately.

After careful consideration and substantial research, we have decided not to offer Zelle due to....